Factoring for Smart

Small-Business Funding

What is a Factoring Company?

How Can Factor Funding Help Your Business?

You might be wondering, “how do you factor to get capital fast?” Whether it’s because you’re a young business, couldn’t get a loan, slow pay, distressing collection calls, or you can’t afford to or don’t want to wait for payment.—your business is too valuable to lose customers simply because of temporary cash shortage.

Rely on a factoring company so you don’t have to turn away or lose business because of cash flow.

Factor Funding offers financial services you need. We are the solution for small business funding and cash advances, offering many small businesses funding options.

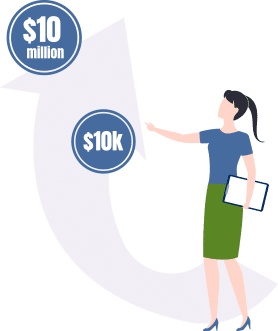

With Factor Funding, you can get quick cash for any amount, from $10K up to $10 million per month!

With Factor Funding on your side, you can receive the cash you need within as little as 24–48 hours after approval, with extended repayment options.

With Factor Funding on your side, you can receive the cash you need within as little as 24–48 hours after approval, with extended repayment options. We aim to improve your cash flow very quickly and empower you to go after bigger accounts, extend payment terms to your customers to generate more sales, get more done, and continue to grow.

Download our

FREE ebook

“An Introduction to Factoring,” to learn the key factoring steps and everything else you need to know about factoring receivables!

Download NowSmall Business Funding

Options We Offer

There are various types of factoring and financing we can take care of for your company so that there’s less work for you. Take a look through the following options:

Accounts receivable factoring, also known as receivables financing, is a method of financing used by businesses to quickly raise capital and improve cash flow. It turns invoices and accounts receivable into immediate cash or lines of credit, and effectively delegates your bill collection activities elsewhere.

An asset-based loan is a loan that is secured or collateralized with one or more assets. Our asset-based loan programs are designed to provide specialized short-term business loans in situations where traditional financing is either unattainable or undesirable.

A merchant cash advance provides a cash advance on future credit, debit, installment sales, and consumer contracts. Alternatively known as consumer receivables, factoring allow you to generate more sales and focus on managing effectively and growing your business, instead of problems of cash flow or collections.

Settlement funding provides lump-sum cash for a portion or all scheduled or likely payments. With settlement, annuity, or lawsuit funding, you can receive a combined lump-sum cash advance on future payments way before they are due or awarded.

A purchase order loan tells a supplier that a buyer, middleman, or end-user has purchased a product from you and that you, the seller, have the funds to pay for it. Purchase order funding provides cash and the proof of ability to pay suppliers so you can procure materials for manufacture or resale products. A purchase order loan bridges the gap between sale and payment and has the advantage of being faster and easier to obtain than a traditional bank loan.

Equipment financing and lease buyback are funding methods that are used by both buyers and sellers to acquire or dispose of new or used equipment either on a short- or long-term basis, generally without a significant cash outlay.

Debt collection is a process that is used to recover overdue and uncollected sums of money and other valuable assets owed. This service turns debts and delinquencies into cash and reduces or eliminates associated losses.

We also provide funds based on outstanding notes, real estate value, or equity. Our real estate, notes, and equity investment program provides funds based on the underlying value of commercial properties, outstanding notes, or equity exchange with little to no restriction on the use of funds.

Why Choose Factor Funding

for Your Small Business Funding Needs?

Perhaps you’ve tried other small business funding options to finance and fuel your company—such as credit cards, bank loans, investors, family and friends, or other lenders—with little to no success. If you have a good business with potential for growth, a reputable factoring company like Factor Funding can speed up your cash flow and unleash your power to survive and thrive—whether you are a one-man team, a duo partnership, or a 100+ person business; working from home or away; already established or just getting started to implement your plans and strategies, buy supplies, meet payroll, pay debts, do your taxes, and meet other expenses.

We use creative financing solutions to provide fast and dependable cash flow to round and growing companies across the U.S. so they not only survive, but thrive.

Unlike conventional lenders, we offer you the best options and advantages of immediate cash flow. We have simple paperwork and work closely with all clients for a personal touch.

As a fellow small business, we understand you, and we want you to feel the meaning of a true partnership—because we sincerely care about your success.

Did you know? Over 80% of businesses fail within five years, often due to cash flow issues. According to the U.S. Chamber of Commerce, approximately 627,000 businesses are started annually, while an estimated 595,000 businesses close. In 2023, about 17,051 businesses filed for bankruptcy, according to statistics released by the Administrative Office of the U.S. Courts.

Small Business Funding

Resources

We love consistently providing small businesses with the resources they need to succeed. Check out some of our most recent articles that will get you on your way to meeting your goals:

Contact Us

For Your Small Business Funding Needs

When looking into invoice factoring companies, you want to make sure you’re working with the best one for you. Contact us to get answers to your most burning financing questions and see how we mesh. Our convenient small business funding can get you where you want to go, faster than you may have ever thought possible.

And you can expect zero obligation and no cost up front—just fast response times. Simply reach out to start a casual conversation. If you like what you hear and you’re ready for things to go further, we’re here for you. We can’t wait to see the new heights your business will reach when you elect to partner with our factoring company.